Year-round business tax services that save you money.

Tax filing is different with Beyond. From year-round bookkeeping to unlimited tax advisory support, we got you covered. No extra fees, no year-end surprises—just expert tax support you can rely on.

An all star tax team

With experts in your corner, tax filing is simple. Our year-round tax support means you’ll never have to worry about missing a deadline again.

Your best return ever

An all-star team means an all-time-great tax return. Bookkeeping and tax services from Beyond ensure you’ll get every deduction you deserve.

Every detail, handled by us

Our services gives you an all-in-one payroll, tax and bookkeeping solution. We keep everything organized for you, every step of the way.

Whatever stage your business is at, you’re covered with Beyond. We cover the tax support, prep, and filing from start to finish.

We do your bookkeeping

Each month, your bookkeeper organizes your business transactions and gets to work on your books. Come year-end, they’ll compile a tidy tax package that contains everything we need to file—and gives you a year-in-review snapshot of your business.

We provide year-round tax support

Tax time stress isn’t limited to tax season. That’s why we offer year-round advisory services through on-demand and unlimited tax consultations. With check-ins throughout the year, your tax team leaves no deductions behind.

We file your taxes

When you’re ready to file, your dedicated Tax Coordinator will collect all necessary documents and forms. Then your Beyond Tax Advisor will facilitate the preparation, review and filing of your income tax return on time, every time.

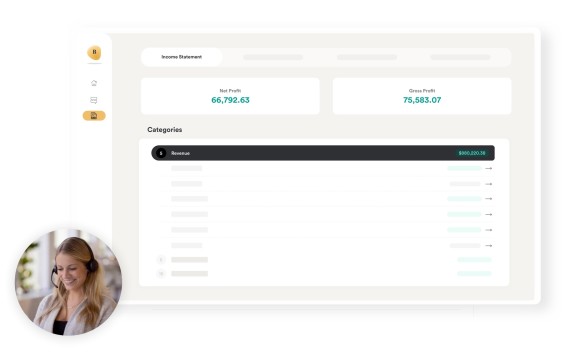

There’s a lot to get organized at tax time. The good news? We bring it all together for you. We call it the Year End Financial Package, and it’s your golden ticket for a stress-free tax season.

See the big picture, annotated

The Year End Financial Package opens with crystal clear notes and an overview of your business. Here’s what’s included:

- Income Statement

- Balance Sheet

- Trial Balance

- Journal Entry Summary

- General Ledger

“It just made so much sense to me”

I cannot say enough about how great Beyond has been for my business.

When it comes to tax filing, there’s a lot of moving pieces. Your team of experts tracks every detail for you, and works in tandem to get you organized and filed on time.

Bookkeeper

Your bookkeeper completes your books and prepares your financials each month. Questions? Chat with your bookkeeper in the Beyond platform, or book a call directly in the app.

Tax Coordinator

Tax season can be overwhelming. That’s why your dedicated Tax Coordinator supports you through the entire process. Need help tracking down tax-related documents or info? Your Tax Coordinator is here to help.

Beyond Tax Advisor

Our Beyond Tax Advisors are licensed tax professionals that facilitate the preparation of your income tax return, review it with you and then get it filed with the IRS and your state. They also provide unlimited, year-round advisory services.

Frequently Asked Questions

With Beyond, you can enjoy peace of mind knowing your books are up to date and organized. Take your time back and focus on what you love – running your business.

Anything and everything tax-related! Here are some examples to get you started:

The IRS just sent me a letter. What does it mean? Do I have to pay quarterly estimates? Should I incorporate my business? Should I write off mileage or get a business vehicle? What are the tax implications of my PPP loan?

Your Beyond Tax Advisors are available year-round, and will answer your questions in 2 business days or less. Don’t have any burning questions? That’s okay, too! We’re still on hand to support you, and can give recommendations based on your unique business needs.

We provide our clients with a modified form of cash basis bookkeeping. With this system, we record transactions as soon as the money has been deposited into your bank or charged to your bank/credit card.

We can complete accrual adjustments like tracking accounts receivable and/or accounts payable, unearned revenue tracking, and more with our specialized accounting add-on. If we are recording accrual adjustments for you, revenues and expenses are recorded when they’re earned throughout the year, regardless of when the money is actually received or paid. At year end we will remove these accrual elements to ensure your bookkeeping is adjusted back to modified cash basis.

If you’re unsure if cash basis bookkeeping will work for your business, talk to us. We’d be happy to understand the needs of your business and determine if Beyond is a good fit for you.

Bookkeeping is the process of recording daily transactions in a consistent way, and is a key component to building a financially successful business. Bookkeepers take care of the day-to-day financials, like posting credits and debits, maintaining the general ledger, and completing payroll.

Accounting is a high-level process that uses financial information compiled by a bookkeeper or business owner, and produces financial models using that information.

Yes, all Bench Tax Advisors are fully licensed and IRS compliant. While these licenses can vary between CPAs, IRS Enrolled Agents, and Tax Attorneys, each of these licenses is granted the same authority for Tax Preparation by the IRS.

Yes! Personal federal and state income tax filings are included for sole proprietors and single member LLC.

For S-Corps, C-Corps, and Partnerships, you can add-on personal filing for 1 partner or shareholder. You may contact us for pricing.

Yes, we’ll prep and file your taxes for you.

Once your bookkeeper completes your year end financials, your dedicated Tax Coordinator and Beyond Tax Advisor will facilitate the preparation, review, and filing of your income tax return. When it’s ready, we’ll reach out to you for the “all clear.” Then, we’ll file your taxes and pull funds directly from your account to pay any applicable taxes.

And since tax time stress isn’t limited to tax season, year-round tax advisory services comes standard. Our licensed tax professionals are on hand for all your tax planning needs. With check-ins throughout the year, your tax team leaves no deductions behind.